Sunflower prices in Ukraine are rising, while oil remains under the pressure of low demand

In the April balance sheet, USDA experts left the forecast for sunflower exports from Ukraine at 2.65 million tons (1.62 million tons in 2021/22), although actual exports may decrease due to restrictions on Ukrainian grain supplies to Poland, Romania, and Bulgaria. The forecast for sunflower processing in Ukraine in 2022/23 was increased by 0.2 to 10.4 million tons, and the estimate of ending stocks was reduced by 0.18 to 1.47 million tons, while last year they amounted to 4.69 million tons.

For the Russian Federation, the sunflower export forecast was reduced by 150 to 700 (235) thousand tons, as a result of which the estimate of final stocks was increased by 0.42 to 1 million tons (0.96 million tons last year).

For Argentina, the forecast for the sunflower harvest in 2022/23 was left at the level of 3.8 million tons, and for processing and export - at the level of 3.45 million tons and 150 thousand tons, respectively. As of April 4, sunflowers in the country have been harvested on 83.5% of the area, and the yield, according to the BAGE exchange, is lower than expected.

In Ukraine, after a sharp fall in March, sunflower prices rose again in early April amid increased demand from processors who hope to resume exports of meal and oil through the grain corridor.

Producers have stopped sunflower sales in anticipation of price recovery to the January level of 16-18 thousand UAH/t, but processors offer only 15-16 thousand UAH/t with delivery to the factory. The increase in sunflower export prices in Romania and Bulgaria to $430-460/t DAP supported the market.

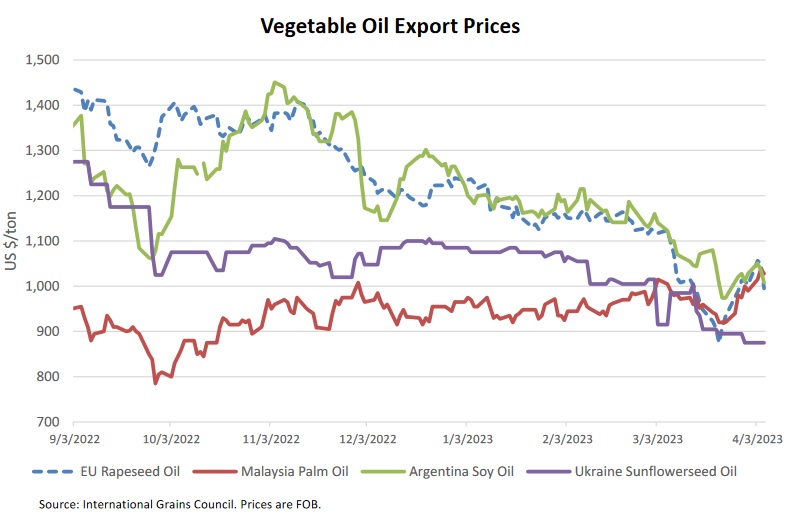

Sunflower oil prices remain at a low level of $900-950/t DAP - EU countries. There is almost no demand as buyers have stocks until the end of the season. Due to the significant surplus of rapeseed oil in the EU, its prices have fallen to a minimum compared to palm oil.

June palm oil futures on Malaysia's Bursa exchange yesterday fell 2.91% to a 12-day low of 3,775 ringgit/t, or $856/t, amid lower exports and forecasts of higher production. The Southern Peninsula Palm Oil Producers Association (SPPOMA) reported that oil production rose by 35% from April 1-10, while oil exports fell by 16.2% from the same period in March - from 487.53 to 408.663 thousand tons, according to surveyor Societe Generale de Surveillance.

Soybean oil futures at the Chicago (CBOT) on data from the USDA report fell by 1.4% to $1,190/t (-3.7% for the month).

As the Eid al-Adha holiday approaches, vegetable oil prices will remain stable, and factories will be closed for a long time due to the holidays.

In China, soybean prices fell on expectations of cheap supplies from Brazil but were supported by a drop in soybean oil exports from Argentina to a 5-year low and high US soybean oil prices due to strong demand from the biodiesel industry.

Brazil has increased the biodiesel blend mandate to 12%, which will increase pressure on soybean oil prices.

According to the USDA forecast, against the background of restrictions on world exports and significant industrial consumption, the share of soybean oil in the world consumption of vegetable oils in 2022/23 will be lower than 30% for the first time in 10 years. Therefore, premiums for soybean and sunflower oil compared to palm oil in the second half of the season may increase, given the reduction in offers from Ukraine and Argentina.

IC UAC according to GrainTrade

- 780 reads